Planning For Your Retirement Already? Great. This Could Help

Requests: 0

Views: 23

Social Security is perhaps the most addressed aspect of retirement planning, yet the least understood.

While many pre-retirees downplay its significance as a small bonus on top of their 401(k), Social Security actually replaces about 40% of an average wage earner’s income after retiring. Millennials and other young professionals are fond of saying, “Who cares? It’s not like it will be there when I retire.”, citing the projection of Social Security reserves being depleted by 2034. Well, we should care, as it is still the largest source of retiree income in America.

What’s it do? Social Security pays an income for life and the life of your spouse. The current system also includes cost of living adjustments based on the Consumer Price Index. The minimum benefit for someone who has worked over 30 years in their career is $848 monthly at their full retirement age. The maximum benefit in 2018 at full retirement age is $2,788 monthly. To be eligible for these benefits you must have worked at least 40-lifetime work credits/quarters, or 10 years.

When do I collect it? Ah, maybe the most important decision in all of retirement. You have considerable flexibility as to when to begin receiving benefits. Some people take the “tomorrow is never guaranteed” approach and collect immediately at age 62. Although, taking your benefits early results in a reduced rate of about one-half of 1% for each month before your full retirement age. Other retirees may delay to age 70, the longest you can defer while still increasing your benefit by 8% annually.

Continuing to work in your 60’s can have a drastic impact on your benefits. If you work and start receiving benefits before full retirement age, your benefits will be reduced by $1 for every $2 in earnings above the prevailing annual limit ($17,040). If you continue to work during the year in which you attain full retirement age, your benefits will be reduced by $1 for every $3 in earnings over a different annual limit ($45,360 in 2018) until the month you reach full retirement age. Once you have attained full retirement age, you can keep working and your benefits under current law will not be reduced, regardless of how much you earn.

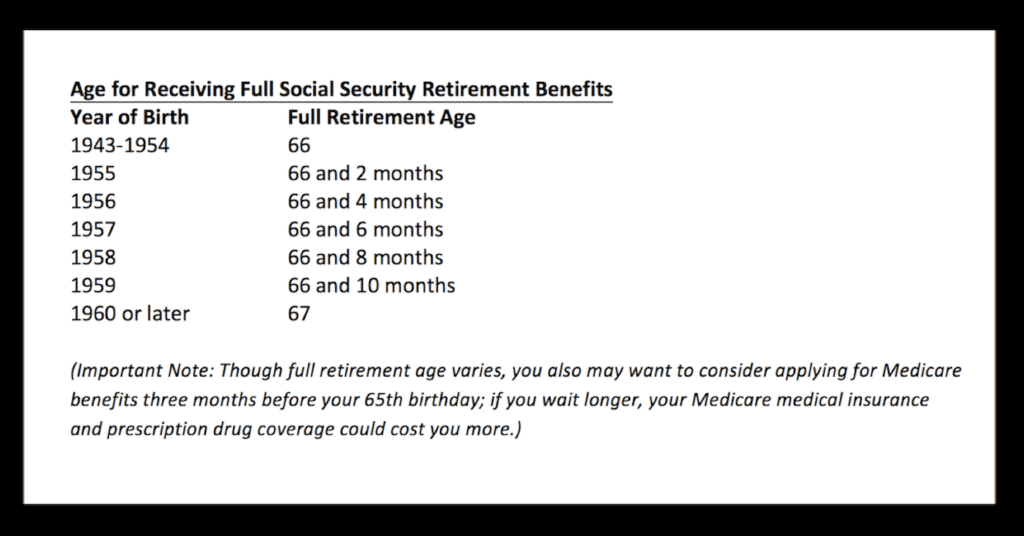

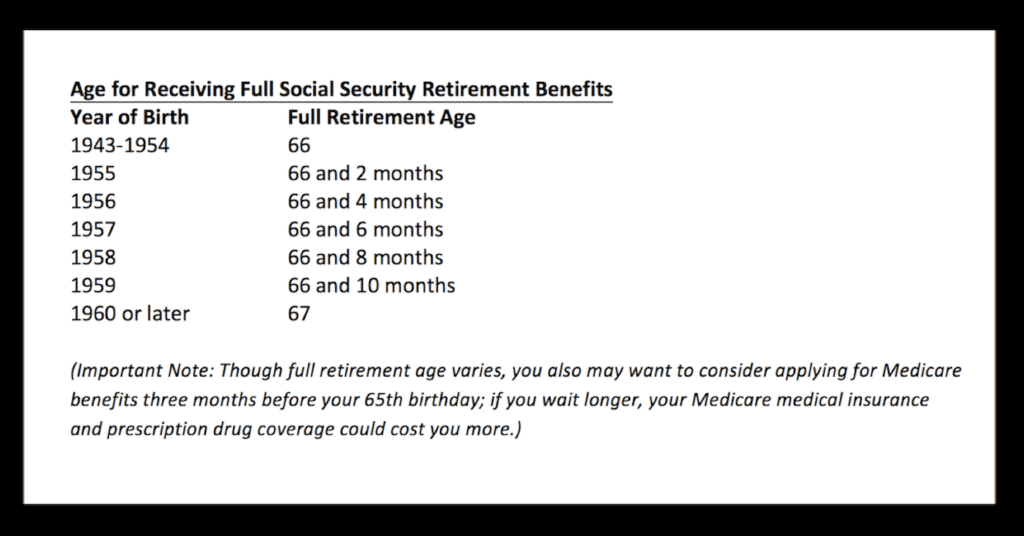

As the accompanying illustration shows, the full retirement age, i.e., the age at which full retirement benefits are payable, depends upon when you were born.

(Note: Though full retirement age varies, you also may want to consider applying for Medicare benefits three months before your 65th birthday; if you wait longer, your Medicare medical insurance and prescription drug coverage could cost you more.)

How’s it all taxed? 50% of your benefit may be federally tax-free for Joint Filers making below $44,000 of combined income, whereas only 15% is exempt from this amount. This consequence should weigh into decisions of when to withdraw retirement money, working in later years, etc. The social security tax for employees still working is 6.20% of earnings up to $128,400 of taxable earnings

What’s in it for my family? When you start receiving Social Security, other family members may also be eligible for payments. A spouse (even if he or she did not have earned income) qualifies for benefits if he or she is age 62 or older, or at any age if he or she is caring for your child (the child must be younger than 16 or disabled). A spouse is entitled to his/her own benefit or 50% of your benefit, the higher of the two. Benefits may also be paid to your unmarried children if they are younger than 18 or between 18 and 19 and enrolled in a secondary school as a full-time student, or if they are age 18 or older and severely disabled.

What are to other benefits? Should you die, your family may be eligible to continue benefits based on your work record. Family members who qualify for benefits include a widow over age 60 (or age 50 if disabled). The widow can continue his/her own benefit, or drop theirs to continue your higher benefit. Unmarried children under 18 (19 if a full-time student). A disabled child (the disability must have started before age 22). Divorcees who were married for at least 10 years, divorced 2 years or longer, unmarried, and at least 62 years old themselves are entitled to 50% of their ex’s benefit once they reach full retirement age (same as if still married). Your benefits are unaffected should your former spouse elect to take Social Security before reaching full retirement age or if your ex-spouse starts a new family.

Obviously, there are many factors to consider before deciding to collect social security benefits. If you knew you’d live until 100, then delaying to the maximum payment at age 70 would be a smart choice. If you were going to get hit by a truck at age 65, then collecting at age 62 certainly paid off. Social Security is not in the business of life insurance, so there is a use it or lose it conundrum to contemplate. Sadly, doctors have not invented the crystal ball predicting how long we’ll live. Therefore, Social Security remains a case-by-case decision that must be factored into overall retirement and estate planning arrangements.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

(Note: Though full retirement age varies, you also may want to consider applying for Medicare benefits three months before your 65th birthday; if you wait longer, your Medicare medical insurance and prescription drug coverage could cost you more.)

How’s it all taxed? 50% of your benefit may be federally tax-free for Joint Filers making below $44,000 of combined income, whereas only 15% is exempt from this amount. This consequence should weigh into decisions of when to withdraw retirement money, working in later years, etc. The social security tax for employees still working is 6.20% of earnings up to $128,400 of taxable earnings

What’s in it for my family? When you start receiving Social Security, other family members may also be eligible for payments. A spouse (even if he or she did not have earned income) qualifies for benefits if he or she is age 62 or older, or at any age if he or she is caring for your child (the child must be younger than 16 or disabled). A spouse is entitled to his/her own benefit or 50% of your benefit, the higher of the two. Benefits may also be paid to your unmarried children if they are younger than 18 or between 18 and 19 and enrolled in a secondary school as a full-time student, or if they are age 18 or older and severely disabled.

What are to other benefits? Should you die, your family may be eligible to continue benefits based on your work record. Family members who qualify for benefits include a widow over age 60 (or age 50 if disabled). The widow can continue his/her own benefit, or drop theirs to continue your higher benefit. Unmarried children under 18 (19 if a full-time student). A disabled child (the disability must have started before age 22). Divorcees who were married for at least 10 years, divorced 2 years or longer, unmarried, and at least 62 years old themselves are entitled to 50% of their ex’s benefit once they reach full retirement age (same as if still married). Your benefits are unaffected should your former spouse elect to take Social Security before reaching full retirement age or if your ex-spouse starts a new family.

Obviously, there are many factors to consider before deciding to collect social security benefits. If you knew you’d live until 100, then delaying to the maximum payment at age 70 would be a smart choice. If you were going to get hit by a truck at age 65, then collecting at age 62 certainly paid off. Social Security is not in the business of life insurance, so there is a use it or lose it conundrum to contemplate. Sadly, doctors have not invented the crystal ball predicting how long we’ll live. Therefore, Social Security remains a case-by-case decision that must be factored into overall retirement and estate planning arrangements.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

(Note: Though full retirement age varies, you also may want to consider applying for Medicare benefits three months before your 65th birthday; if you wait longer, your Medicare medical insurance and prescription drug coverage could cost you more.)

How’s it all taxed? 50% of your benefit may be federally tax-free for Joint Filers making below $44,000 of combined income, whereas only 15% is exempt from this amount. This consequence should weigh into decisions of when to withdraw retirement money, working in later years, etc. The social security tax for employees still working is 6.20% of earnings up to $128,400 of taxable earnings

What’s in it for my family? When you start receiving Social Security, other family members may also be eligible for payments. A spouse (even if he or she did not have earned income) qualifies for benefits if he or she is age 62 or older, or at any age if he or she is caring for your child (the child must be younger than 16 or disabled). A spouse is entitled to his/her own benefit or 50% of your benefit, the higher of the two. Benefits may also be paid to your unmarried children if they are younger than 18 or between 18 and 19 and enrolled in a secondary school as a full-time student, or if they are age 18 or older and severely disabled.

What are to other benefits? Should you die, your family may be eligible to continue benefits based on your work record. Family members who qualify for benefits include a widow over age 60 (or age 50 if disabled). The widow can continue his/her own benefit, or drop theirs to continue your higher benefit. Unmarried children under 18 (19 if a full-time student). A disabled child (the disability must have started before age 22). Divorcees who were married for at least 10 years, divorced 2 years or longer, unmarried, and at least 62 years old themselves are entitled to 50% of their ex’s benefit once they reach full retirement age (same as if still married). Your benefits are unaffected should your former spouse elect to take Social Security before reaching full retirement age or if your ex-spouse starts a new family.

Obviously, there are many factors to consider before deciding to collect social security benefits. If you knew you’d live until 100, then delaying to the maximum payment at age 70 would be a smart choice. If you were going to get hit by a truck at age 65, then collecting at age 62 certainly paid off. Social Security is not in the business of life insurance, so there is a use it or lose it conundrum to contemplate. Sadly, doctors have not invented the crystal ball predicting how long we’ll live. Therefore, Social Security remains a case-by-case decision that must be factored into overall retirement and estate planning arrangements.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

(Note: Though full retirement age varies, you also may want to consider applying for Medicare benefits three months before your 65th birthday; if you wait longer, your Medicare medical insurance and prescription drug coverage could cost you more.)

How’s it all taxed? 50% of your benefit may be federally tax-free for Joint Filers making below $44,000 of combined income, whereas only 15% is exempt from this amount. This consequence should weigh into decisions of when to withdraw retirement money, working in later years, etc. The social security tax for employees still working is 6.20% of earnings up to $128,400 of taxable earnings

What’s in it for my family? When you start receiving Social Security, other family members may also be eligible for payments. A spouse (even if he or she did not have earned income) qualifies for benefits if he or she is age 62 or older, or at any age if he or she is caring for your child (the child must be younger than 16 or disabled). A spouse is entitled to his/her own benefit or 50% of your benefit, the higher of the two. Benefits may also be paid to your unmarried children if they are younger than 18 or between 18 and 19 and enrolled in a secondary school as a full-time student, or if they are age 18 or older and severely disabled.

What are to other benefits? Should you die, your family may be eligible to continue benefits based on your work record. Family members who qualify for benefits include a widow over age 60 (or age 50 if disabled). The widow can continue his/her own benefit, or drop theirs to continue your higher benefit. Unmarried children under 18 (19 if a full-time student). A disabled child (the disability must have started before age 22). Divorcees who were married for at least 10 years, divorced 2 years or longer, unmarried, and at least 62 years old themselves are entitled to 50% of their ex’s benefit once they reach full retirement age (same as if still married). Your benefits are unaffected should your former spouse elect to take Social Security before reaching full retirement age or if your ex-spouse starts a new family.

Obviously, there are many factors to consider before deciding to collect social security benefits. If you knew you’d live until 100, then delaying to the maximum payment at age 70 would be a smart choice. If you were going to get hit by a truck at age 65, then collecting at age 62 certainly paid off. Social Security is not in the business of life insurance, so there is a use it or lose it conundrum to contemplate. Sadly, doctors have not invented the crystal ball predicting how long we’ll live. Therefore, Social Security remains a case-by-case decision that must be factored into overall retirement and estate planning arrangements.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

Reactions