Don't Be Deceived. Here's The Growing Cost Of Identity Fraud

Requests: 0

Views: 7

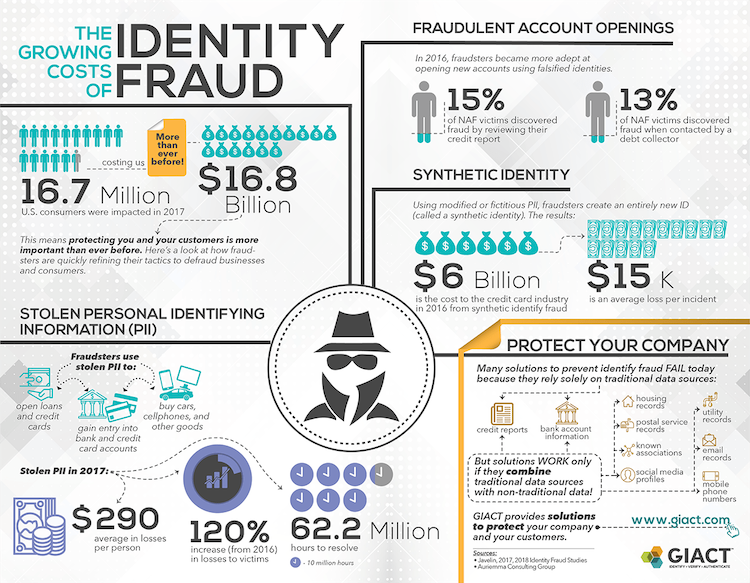

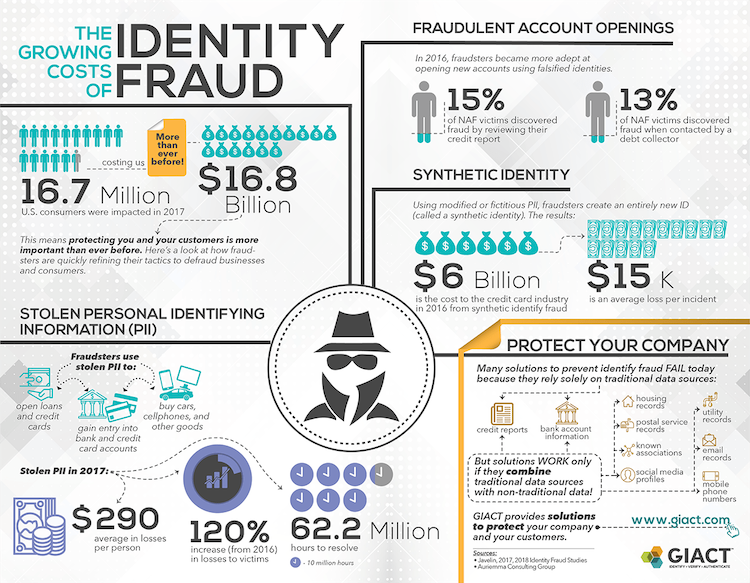

Identity fraud is no small issue, and yet it seems to keep growing year after year. The years 2017 and 2018 showed a record for both the number of people affected by identity fraud and the total cost identity fraud created; 16.7 million U.S. consumers were affected, costing a whopping total of $16.8 billion. In fact, Millennials reported more cases of identity theft than senior citizens in 2017.

Read more about how to protect yourself from identity theft here.

Read more about how to protect yourself from identity theft here.

Stolen Personal Identifying Information

Stolen personal identifying information, or PII, can be used for a wide variety of things by fraudsters. PII, when in the wrong hands, can be used to open loans and credit cards, gain entry into banks and credit card accounts and even buy cars and cell phones. Stolen PII can be incredibly costly for victims of this type of fraud. Stolen PII in 2017 led to an average of $290 in losses per person affected, an increase of 120% over the previous calendar year. It can lead to lost time as well while trying to resolve the issues as well. In 2017, issues involving stolen PII took a grand total of 62.2 million combined hours to resolve.Fraudulent Account Openings And Synthetic Identity

Stolen PII can lead to a vast number of terrifying problems for consumers, especially if left undiscovered or unchecked. In 2016, 15% of NAF victims only discovered that they had been victims of fraud by checking their credit reports, and an additional 13% discovered that they’d been victims of fraud when they were contacted by a debt collector. In these cases, fraudsters were so convincing that the only way the victims found out was, essentially, on pure accident. In recent years, fraudsters have gotten more adept not only at stealing PII, but also falsifying identities, leading to many problems for businesses and consumers alike. These synthetic IDs can be incredibly expensive for companies to identify and resolve. Synthetic IDs cost the credit card industry a total of $6 billion in 2016, with an average loss of $15k per incident.How To Stay Safe And Protect Against Fraud

There are a variety of methods available to help you protect yourself against fraud, from checking credit records and bank account information to keeping documentation of your transactions and digital communications. However, these methods only work if used together, and will not be enough if used individually. Make sure you double up on your security methods to keep your PII safe from fraudsters. Read more about how to protect yourself from identity theft here.

Read more about how to protect yourself from identity theft here.

Reactions