Millennials are on the verge of surpassing Baby Boomers as the nation’s largest generation. This means that this large, diverse segment of the population will play an important part in the future of the American economy.

However, Millennials are delaying many of the more traditional achievements considered to be milestones on the road to adulthood. One of such road markers is homeownership. Despite recent increases, the Millennial homeownership rate still significantly lags that of previous generations at a similar age. So yes, homeownership is getting better, but more change is needed for our generation.

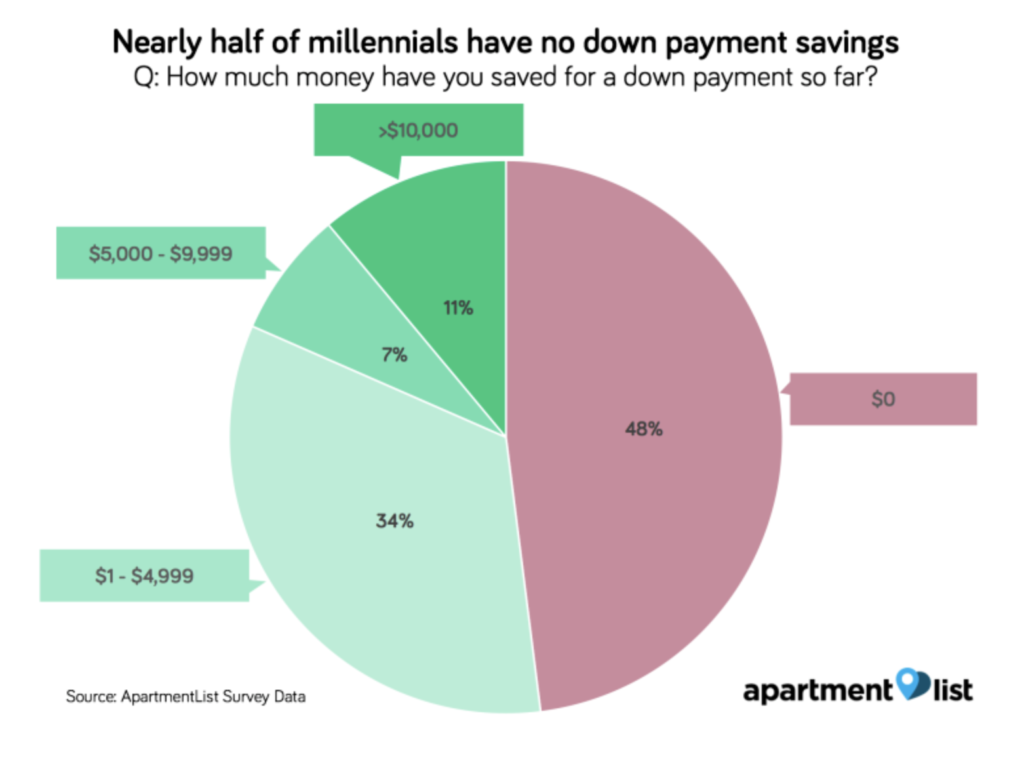

For most American homeowners, their house is their largest financial asset, and homeownership has long been the key source of wealth creation for many American families. Apartment List’s new survey shows that homeownership is still a goal that the vast majority of Millennial renters aspire to, with 89.4% of respondents saying that they plan to purchase a home at some point in the future. 11% would be able to amass a 20% down payment within the next five years. While the overwhelming majority of Millennial renters still value homeownership, most face significant financial hurdles in turning that goal into a reality, with down payment savings posing the largest obstacle.

According to NAR that the median down payment was 13% in the last year. For first-time buyers, the median down payment was much lower at 7%. Low down payment options are becoming more popular as Millennials want to buy homes, but find the down payment to be a massive barrier. Lenders and new companies are taking note and offering new products as a result. Several startups are prototyping new models of down payment assistance, targeting Millennials in particular. This model fronts down payments in exchange for future profits from the home. This helps get Millennials into starter homes, but it increases risk exposure.

Companies such as Unison Agreement Corp. and Landed Inc., and banks such as Bank of America Corp. and Morgan Stanley, present first-time home buyers with “shared equity” contracts. “Shared equity” contracts allow buyers to get money for their down payments in exchange for pledging part of the home’s future value to investors or if their parents pledge investment assets as collateral.

As a matter of fact, many Millennial renters simply don’t actually want to be tied down by homeownership in the near-term. The share of those who expect to always rent has been on the rise, Apartment List’s survey shows. Additionally, Millennials are less likely to view homeownership as central to the American Dream entirely. 34.0% say that they aren’t yet ready to settle down in their current city. 28.1% say that they want to get married or find a long-term partner before buying a home. Preference for flexibility is also playing a role in Millennials delaying homeownership.

In order to identify the best metros for Millennials, Apartment List created an index to grade 75 top U.S. metros on jobs, affordability and livability. Largely, Midwest and South metros rank higher than coastal metros, offering affordable options, strong job markets, and plentiful entertainment for Millennials. The best three metros for Millennials are Pittsburgh, Provo, and Madison.

Metros traditionally favored by Millennials, such as San Francisco, Los Angeles and New York and newfound favorites Seattle, Austin, and Denver, scored low for affordability for Millennials. Despite strong job markets, rents in these metros are too unaffordable for many Millennials, and homeownership is far out of reach for most. A lot is needed to change, and I’m believing it will.