10 Smart Money-Saving Advice From Entrepreneurs Who Started From 0

Today we live in the era of the “economy of individuals”, where more and more people tend to be self-employed or own their own business. And with all the opportunities of the emerging world of digitalization, it is not even surprising. We can’t help but stress that in 2020 as a small business owner you don’t need huge investments to become your own boss and provide value to your potential customers. Instead, you need an idea and consistent, patient efforts in making this idea into something big. On the other hand, you might need to work on your regular 9/5 job to provide to your own business and here it is very important to understand your income and separate not only your time but finances as well between your personal and business ones. We collected the best money-saving advice from entrepreneurs who took their own path with zero budget to help and inspire you. It is time to go and start doing it!

“A Penny Saved is a Penny Earned”

In a business perspective, the key is to save as much no matter how small. This may not look like it has an impact but overtime, you’ll be surprised at how much savings you’ve earned.

- Track everything you spend on the business. This will help you see if you're actually making a profit, and things can start to get fuzzy when you're using personal money to fund your business, then putting the profits into a separate account.When starting out it is a great idea to "loan" yourself a few thousand dollars, write it down, and then pay yourself back through sales. This will keep your personal finances separate from my business ones, making taxes much easier.

- We know how tempting it is, but try not to spend money on things like fancy brochures, letterhead, business cards etc. You can make them anytime, but for the beginning a professional email address and professional signature is more important and it is also eco-friendly.

- Pay for everything through one credit card. At the end of each month, download the statement and break down every line item and what it was used for. If you’re using a business credit card, pay your balances in full where possible, and if not, pay as much as you can every month, never below the minimum payments.

- Follow the Lean Startup Methodology (Eric Ries) - operate with a feedback loop by testing (experimenting) on a small scale before rolling out something new.

- Focussing on revenue growth is essential, but it’s equally as important to always keep a close eye on costs. At the onset of COVID-19, many businesses looked at costs and started slashing.

- Carefully monitor your costs on an on-going basis, not just during a crisis. Practice keeping an open mind and an agile mentality. Decide to be a continuous learner.

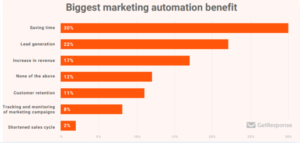

Automate Processes As Much As You Can

When starting a business, you’ll find out quickly how much money and time is spent on repetitive tasks. As the adage goes: time is money. A study conducted by McKinsey suggests that an average person spends 60 percent of the working time on tasks like answering emails, gathering data and communication, which leaves them only 39 percent of time to dedicate to their role-specific activity. The key is to find the right software options that can help to automate processes such as meeting/appointment scheduling, billing/invoicing, inventory management, integrating sales funnels in a CRM system, email marketing, document collaboration, and secure file sharing. This eliminates the need to hire paid staff for these tasks, which helps optimize your savings. Not only automation allows tracking but also monitors how much you are making each month, as well as where your clients are coming from. As a small business, having that knowledge allows an entrepreneur to focus on future budgets for specific areas that they need versus being financially irresponsible and blindly investing in marketing.

Now this doesn’t mean you have to purchase every software out there and put the blame on it if something goes wrong. Adopting an automation software should rather be a strategically considered decision. For example, if your email marketing solemnly aims at delivering right messages to your partners and potential clients at the right time, your best decision will be installing an email follow-up extension, as this tool is as easy-to-use as it is cost-effective. This software will automate your follow-up email until you get a response. This way you’ll be sure that no negotiation and sales opportunity is lost in a sea of your or the recipients’ inboxes.

Use Money Management Software from the Beginning

An accounting software (duh!)

This is a fantastic one-stop-shop for entrepreneurs to monitor progress and to keep everything in order. There are folders you can set up to file all your company documents, contracts, employment agreements etc in one place. As you grow, there is a myriad of specialist add-ons that allow systems and processes to fast scale to the needs of your business.

Personal Income Tracking

- Personal Capital - this app lets you monitor your budget and at the same time track your investment accounts. It also provides an easy to read investments by asset class, account and your individual investments, giving you a full view of your financial picture.

- Pocket Guard - this app is most helpful in managing your regular spend and helps you budget your finances and analyze your spending. It will also give you a view of month-to-month spending trends and track your individual bills.

Hire Interns To Assist You

Students need work experience and great references. Startups need new energetic minds equipped with the latest talent and skill sets to keep them pivoting, growing, and innovating. A great way to maximize saving is by cultivating relationships with students in their first year at school with the agreement to hire them over the summer months as they move through their learning programs. It's a win-win. And even in these times of uncertainty, recent studies show that canceling your summer internship opportunities is not the best decision to make.

Practice networking all the time

Many people start to network when there is something that they need. If you work on building networks, then you already have people to go to when you are looking for something in particular. As we enter 2020 networking becomes more and more automated. The digital transformation and emerging technologies for networking are essential to assure success for IT teams and others.